Find aDomain Search Powered byGoDaddy.com ...

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as mortgage loan refinancing or a particular type of real estate transaction or joint venture.

We earn commissions if you shop through the links below. Read more

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Published on December 30, 2021

Updated on September 23, 2022

Investment range

$2,250 - $32,100

Revenue potential

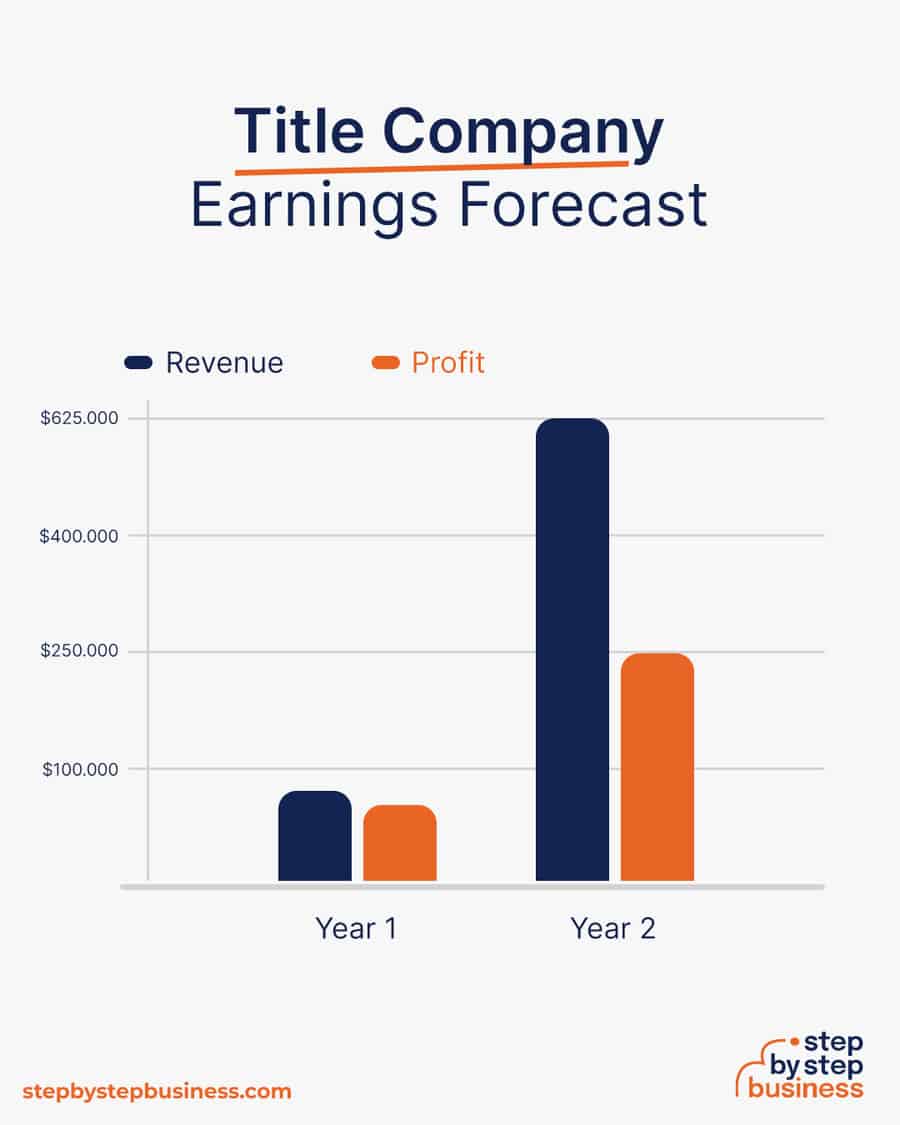

$80,000 - $625,000 p.a.

Time to build

1 – 3 months

Profit potential

$70,000 - $250,000 p.a.

Industry trend

Growing

Commitment

Flexible

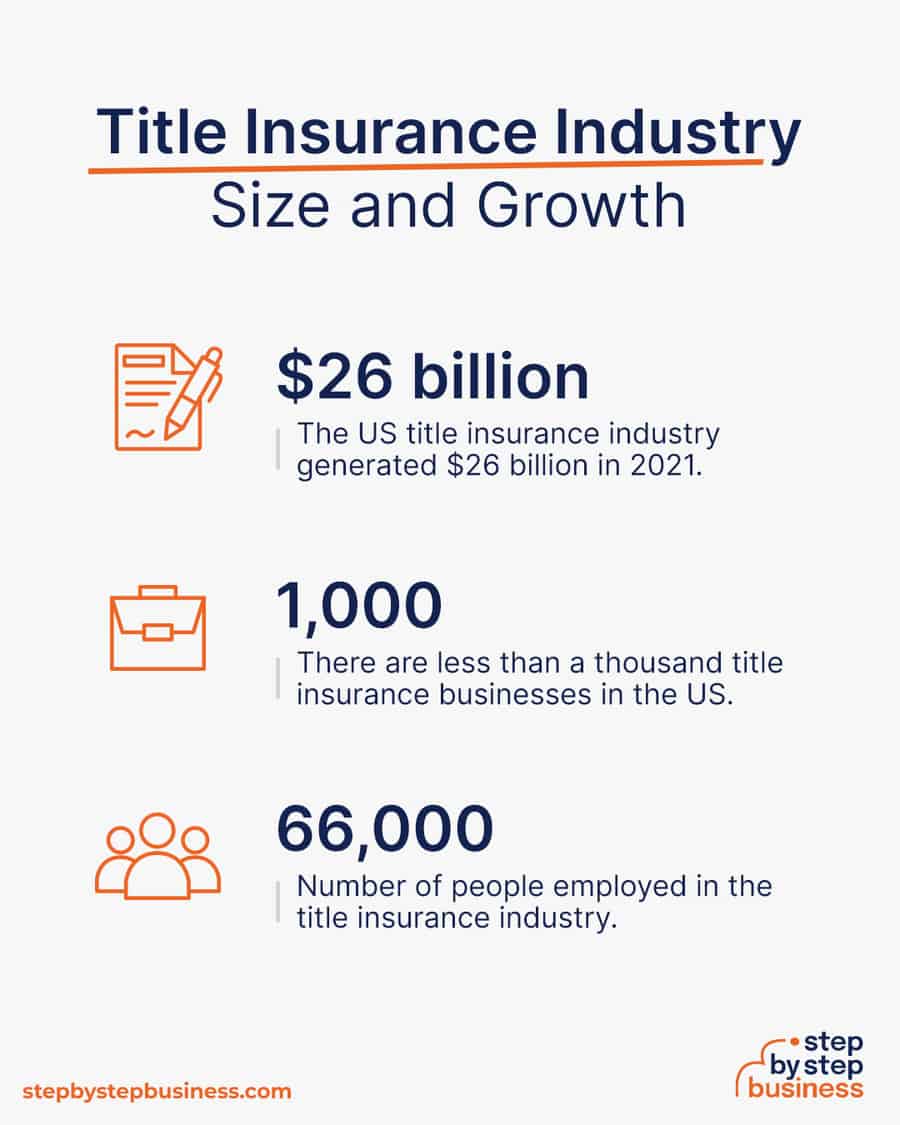

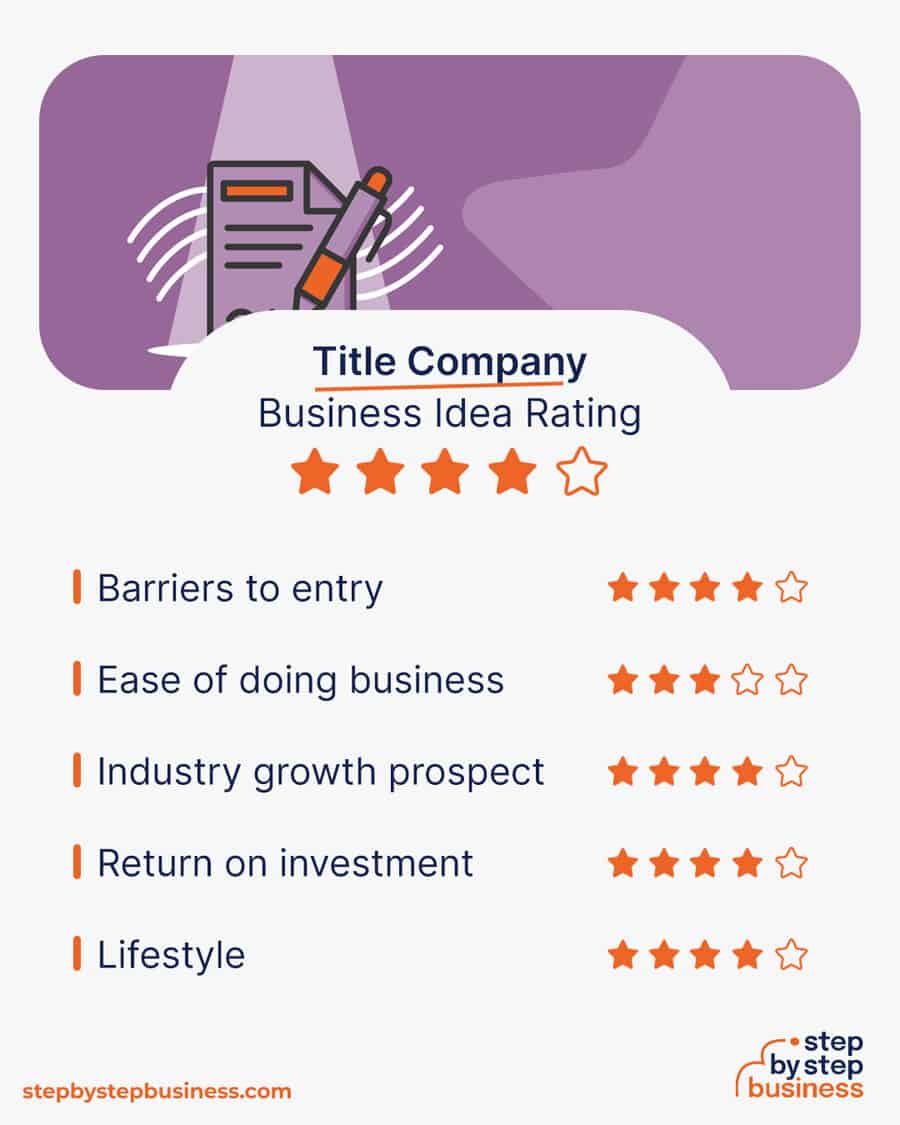

We rarely think about it, but title insurance is big business, with a US market value of $22 billion. Now might be a great time to start a title company, which helps ensure the smooth transfer of ownership of homes, property, and other assets, and get in on a fast growing market.

Of course, starting a business comes with challenges and will require preparation, hard work, and industry knowledge. Fortunately, you’ve come to the right place, as this step-by-step guide has all the information and insight you need to develop and launch your own title company.

Starting a title company, which handles the paperwork for funds transfers and works with title insurance underwriters to make sure everything is in legal and financial order, has pros and cons that you should consider before you decide if the business is right for you.

The pandemic forced a digital transformation of the US title insurance industry. Documents can now be notarized digitally, eliminating the need for an in-person closing. For more on digital notarization and starting your own notary, read this Step By Step article.

Funds are also being transferred electronically, eliminating the need for buyers to bring a cashier’s check to closing. Mobile title companies, meanwhile, are offering their services to mortgage brokers.

Title insurance trends include:

Challenges in the title industry include:

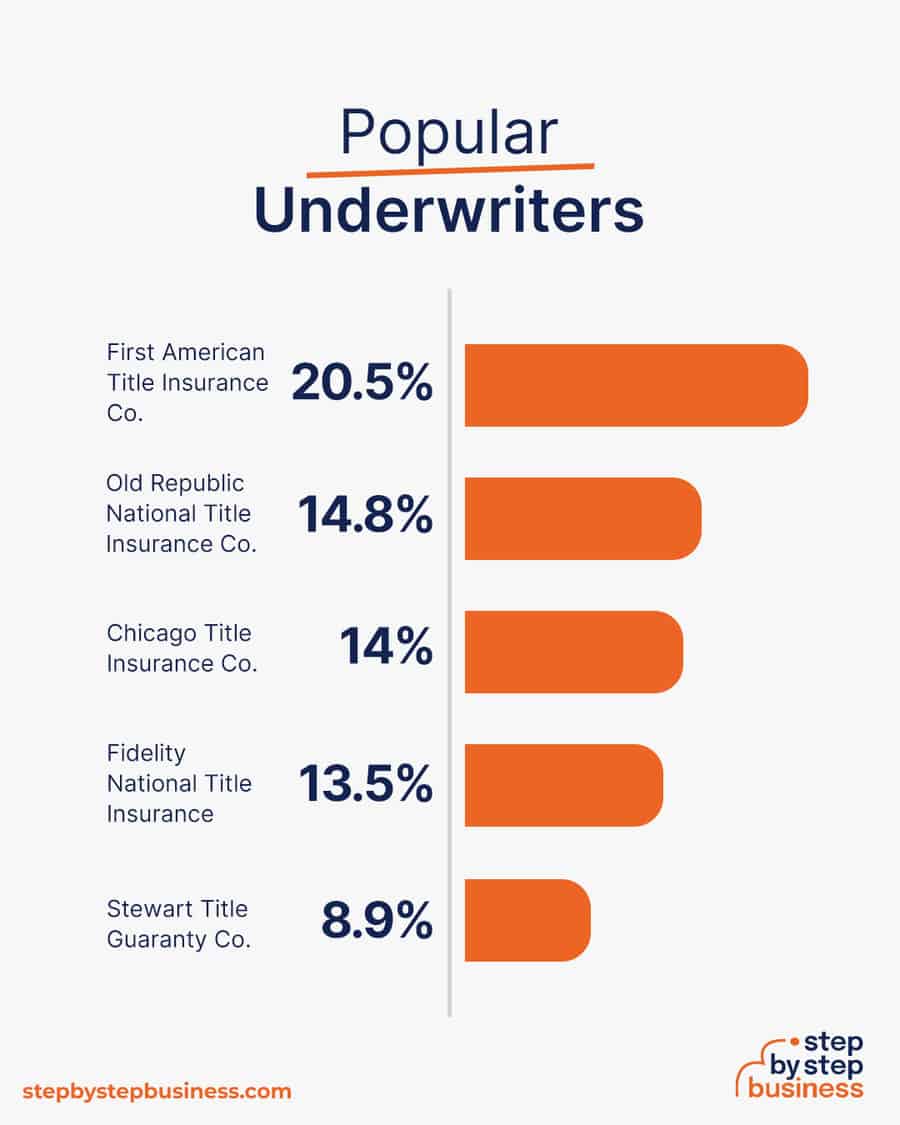

The top title insurance underwriters in 2021 and their market share were:

An insurance underwriter evaluates insurance applications.

Startup costs for title companies range from $2,000 to $32,000. The lower end is the cost if you start as a mobile title agent, while the high end includes the rental and preparation of office space.

You’ll need a handful of items to successfully launch your title company. Here’s a list to get you started:

| Startup Costs | Ballpark Range | Average |

|---|---|---|

| Setting up a business name and corporation | $150 - $200 | $175 |

| Licenses and permits | $100 - $300 | $200 |

| Insurance | $100 - $300 | $200 |

| Business cards and brochures | $200 - $300 | $250 |

| Website setup | $1,000 - $3,000 | $2,000 |

| Training and licensing | $300 - $500 | $400 |

| Surety and Fidelity bonds | $400 - $1.500 | $950 |

| Office space security deposit | $0 - $6,000 | $3,000 |

| Office equipment and furniture | $0 - $20,000 | $10,000 |

| Total | $2,250 - $32,100 | $17,175 |

Before you can start making money, you need to take the training and pass the exam to become a licensed title agent. Each state has its own requirements for licensing. Typically the process takes no more than 1-2 weeks, and will cost $75 to $200.

The typical fee paid to a title company or title insurance company at closing is about $300. As a mobile agent working from home, your profit margin should be about 90%.

In your first year or two, you could do 5 closings a week, bringing in nearly $80,000 in annual revenue. This would mean over $70,000 in profit, assuming that 90% margin. As your brand gains recognition, you’d likely rent an office and hire staff, reducing your margin to 40%. If you do 40 closings a week, your annual revenue would be almost $625,000, and you’d make a tidy profit of about $250,000.

There are a few barriers to entry for a title company. Your biggest challenges will be:

Now that you know what’s involved in starting a title company, it’s a good idea to hone your concept in preparation to enter a competitive market.

Research other title companies in your area to examine their services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a mobile title service, or a reliable title insurance business with an appealing website.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as mortgage loan refinancing or a particular type of real estate transaction or joint venture.

This could jumpstart your word-of-mouth marketing and attract clients right away.

You’ll need to decide if you want to offer in-person closings, mobile closings, digital closings, or all three. You’ll also need to find a reliable title insurance underwriting company to partner with. Four main companies, known as the Big Four, are the most used: Fidelity National Financial, First American Financial, Old Republic, and Stewart Information Services.

The average fee a title company receives for a closing is $300. As a mobile service working out of your home, your only costs will be for paperwork and fuel. When you open an office, you’ll have rent, overhead, and labor costs. You’ll still want to provide mobile services at this point, but you’ll be able to do in-person closings as well to increase your volume.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

As a mobile service, your target market will be mainly mortgage brokers who will engage you for refinance transactions. Once you have an office for in-person closings, your target market will expand to realtors, but you’ll still want to connect with mortgage brokers for the mobile part of your business. Both of those target markets can be found on business-related sites like LinkedIn.

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in your area on Craigslist, Crexi, and Commercial Cafe.

When choosing a commercial space, you may want to follow these rules of thumb:

Your business name is your business identity, so choose one that encapsulates your objectives, services, and mission in just a few words. You probably want a name that’s short and easy to remember, since much of your business, and your initial business in particular, will come from word-of-mouth referrals.

Here are some ideas for brainstorming your business name:

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that set your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Every business needs a plan. This will function as a guidebook to take your startup through the launch process and maintain focus on your key goals. A business plan also enables potential partners and investors to better understand your company and its vision:

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist at Fiverr to create a top-notch business plan for you.

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you are planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to title companies.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

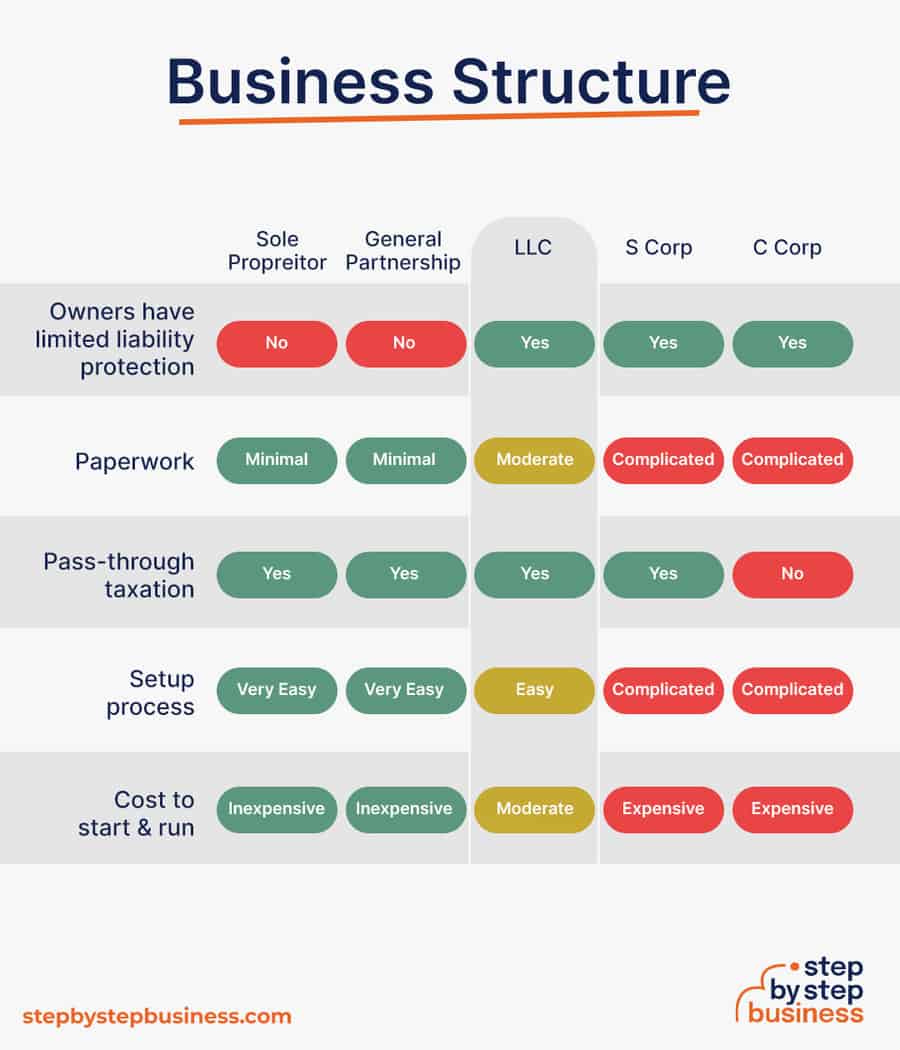

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your title company will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using ZenBusiness’s online LLC formation service. They will check that your business name is available before filing, submit your articles of organization, and answer any questions you might have.

The final step before you’re able to pay taxes is getting an Employer Identification Number, or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist, and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you are completing them correctly.

Securing financing is your next step and there are plenty of ways to raise capital:

Bank and SBA loans are probably the best options, other than friends and family, for funding a title insurance business.

Starting a title company business requires obtaining a number of licenses and permits from local, state, and federal governments.

You should check your state website for education and licensing requirements to become a licensed title agent. You’ll also need to check your state’s requirements for surety and fidelity bonds. The amount of the bonds that you need will vary by state.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration (OSHA), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package. They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Before you start making money you’ll need a place to keep it, and that requires opening a bank account. Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your title company business as a sole proprietorship.

Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You can use industry-specific software, such as snapclose, eFileCabinet, or Certifid, to manage your documents, data collection, closing process, and accounting.

Some of your business will come from online visitors, but still, you should invest in digital marketing! Getting the word out is especially important for new businesses, as it’ll boost customer and brand awareness.

Once your website is up and running, link it to your social media accounts and vice versa. Social media is a great tool for promoting your business because you can create engaging posts that advertise your products:

Take advantage of your website, social media presence, and real-life activities to increase awareness of your offerings and build your brand. Some suggestions include:

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism. They are unlikely to find your website, however, unless you follow Search Engine Optimization (SEO) practices. These are steps that help pages rank higher in the results of top search engines like Google.

You can create your own website using services like WordPress, Wix, or Squarespace. This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

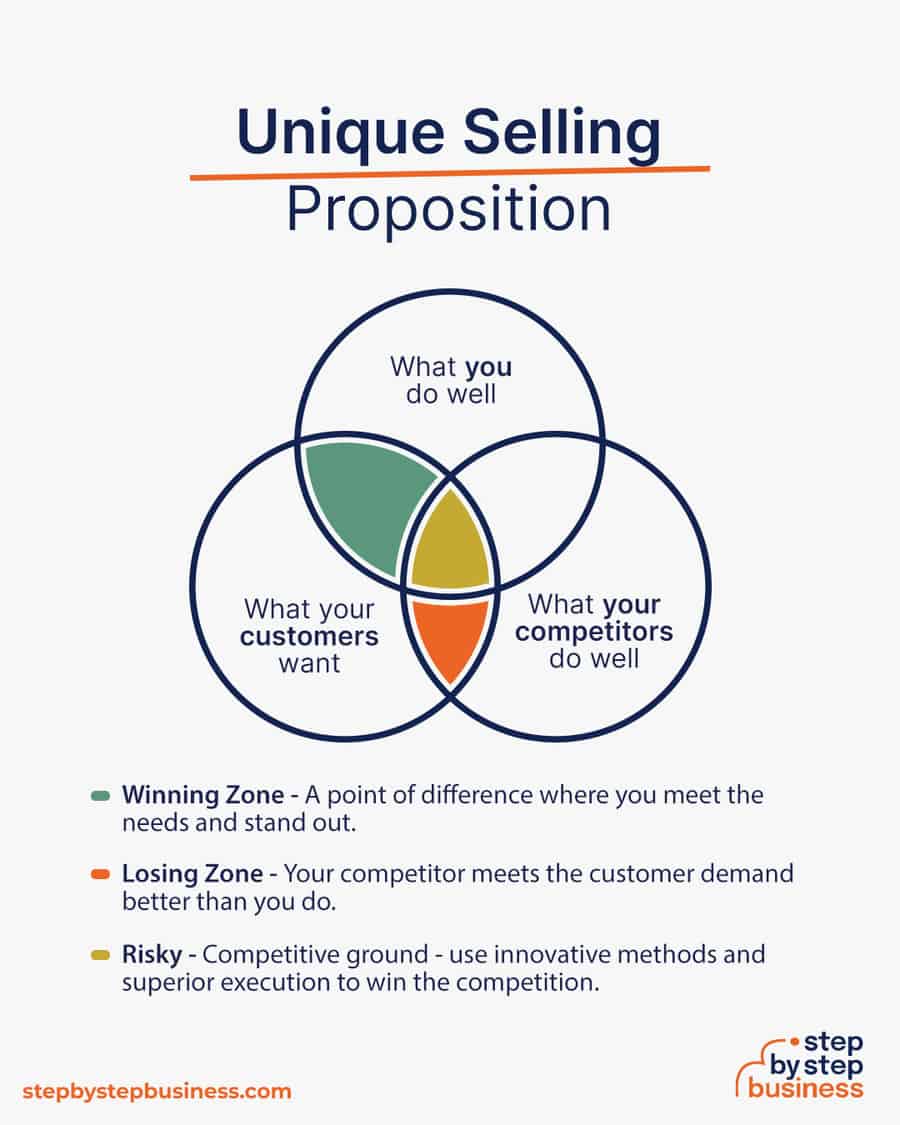

Unique selling propositions, or USPs, are the characteristics of a product or service that set it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your title company meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your title company could be:

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a title insurance business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in insurance or title underwriting for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in titles and insurance. You’ll probably generate new customers or find companies with which you could establish a partnership. Online businesses might also consider affiliate marketing as a way to build relationships with potential partners and boost business.

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a title company business would include:

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed, Glassdoor, or ZipRecruiter. Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Title companies perform an essential service that protects homeowners and lenders. It’s a large industry in the US, and its market size has nearly doubled in the last decade alongside a real estate boom.

A bold entrepreneur can grab a share of this lucrative market and make good money. You can start small as a mobile service and eventually grow to have multiple brick-and-mortar locations. Startup costs are relatively low, and the process of becoming licensed does not take long.

Now that you have all the information you need, you’re ready to start your entrepreneurial journey to building a title empire!

You can start small, offering mobile title services for just over $2,000, then build a reputation and eventually open your own office.

Title companies collect about $300 per loan closing. So if your company does 8 closings per day 5 days a week, your annual revenue will be more than $600,000.

Every state has its own licensing requirements. Generally, you have to complete a certain number of education hours and pass an exam. Check your state’s website for requirements.

Title insurance protects the homeowner and lender from potential defects in a title. Defects might be unsatisfied liens, legal issues, or even clerical errors.

Published on August 16, 2023

Find aDomain Search Powered byGoDaddy.com ...

Read Now

Published on March 16, 2023

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, ...

Read Now

Published on March 10, 2023

When to Use Paychex Flex When to Use QuickBooks Payroll ...

Read Now

No thanks, I don't want to stay up to date on industry trends and news.

Comments